Should I file my Taxes in 2025?

Tax season can be a stressful time, but understanding whether you need to file your taxes in 2025 (for the 2024 tax year) is crucial. Many people wonder if they should file, even if they don’t owe taxes or earn below the threshold. Let’s break down who should file, why it matters, and the potential benefits of filing even when it’s not mandatory.

Who Is Required to File Taxes in 2025?

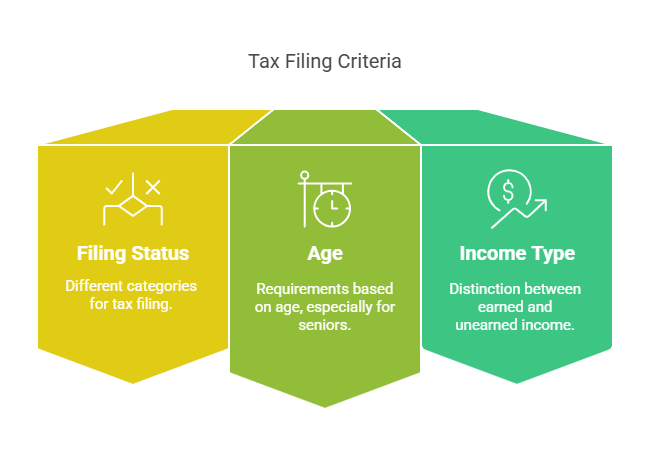

The IRS sets specific income thresholds that determine whether you must file a tax return. These thresholds depend on factors such as:

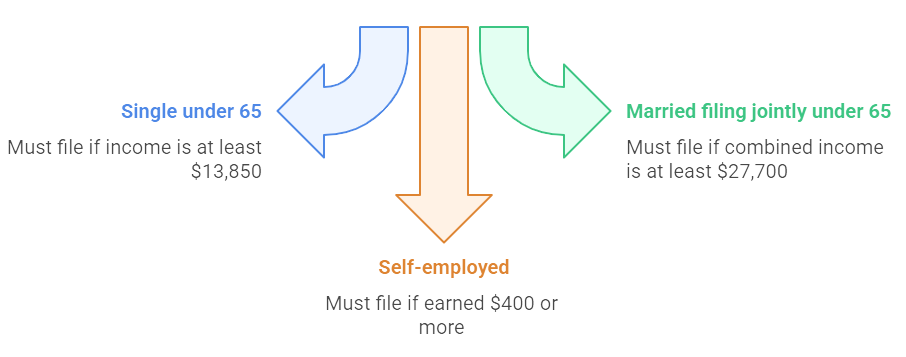

For example, in the 2024 tax year, if you are:

These numbers may change slightly in 2025, so checking with the IRS or a tax professional is essential.

Why You Should File Even If You’re Not Required Even if your income is below the required threshold, filing your taxes may still be beneficial. Here’s why:

1. Claim a Refund:

If taxes were withheld from your paycheck, you might be eligible for a refund—even if you didn’t earn much. Filing your taxes allows you to get back money that was deducted.

2. Qualify for Tax Credits:

Some tax credits, such as the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC), are refundable, meaning you could receive money even if you owe no taxes. If you qualify but don’t file, you’re leaving free money on the table.

3. Build Your Financial Record:

Having a tax return on file helps establish financial credibility. It can be useful when applying for loans, mortgages, or government benefits.

4. Avoid Penalties and Interest:

If you mistakenly assume you don’t need to file and later find out you do, you could face penalties for late filing and interest on unpaid taxes.

5. Protect Against Identity Theft:

Filing your tax return early helps prevent scammers from filing a fraudulent return in your name and claiming your refund.Special Situations to Consider

Freelancers and Gig Workers:

Even if you don’t receive a W-2, you must report all income, including from side hustles or online work.

Retirees:

Social Security benefits are generally not taxable unless combined with other income. However, pension or investment income may require you to file.

Students and Young Workers:

If you worked part-time or had taxes withheld from your paycheck, filing can help you get a refund.If you determine that you should file your taxes, here’s how to do it

1 - Gather Your Documents: Collect W-2s, 1099s, and other income statements.

2 - Choose Your Filing Method: You can file online using IRS Free File (if eligible), tax software like TurboTax, or hire a tax professional.

3 -Submit Before the Deadline: The tax filing deadline is typically April 15, 2025, but check for any extensions or changes.

Final Thoughts

Filing your taxes in 2025 may not always be legally required, but it can be beneficial. Whether you want to claim a refund, qualify for tax credits, or avoid penalties, filing your return is often a smart financial move. When in doubt, consult a tax professional to ensure you’re making the right decision.

Are you ready for tax season? Start preparing today! Nrfservices.com is here for you.

6 Comments

Jessica Smith Reply

"I had no idea age could impact tax filing until I read your post. Your insights helped me ensure I met all the necessary requirements. Much appreciated!"

Kwame Osei Reply

"Thanks to your guidance, I finally understood the different filing statuses. It made my tax filing process so much smoother this year!"

Amina Diallo Reply

"Yes me too. The section on income types was a game changer for me. I feel much more confident in my understanding of earned vs. unearned income now. Thank you!"

Karen S. Reply

"I hear you, I used to dread tax season, but now I see it differently. It’s amazing how much perspective can change our feelings about these things!"

David W. Reply

"I used to view taxes as a burden, but now I understand their importance. This service has changed my perspective entirely!"

Michael Johnson Reply

"Your tips on selecting the right filing status were incredibly helpful! I was unsure about my situation, but your examples clarified everything."