The Importance of Filing Taxes: Why You Can't Afford to Miss the Deadline

As the tax filing season approaches, many individuals and businesses may wonder why filing taxes is necessary. While it may seem like a tedious and time-consuming process, filing taxes is a critical obligation that comes with significant benefits. In this blog post, we'll explore the importance of filing taxes and what happens if you fail to do so.

"As the tax filing season approaches, many wonder why it's necessary, but filing taxes is a critical obligation with significant benefits."

Why File Taxes?

1. Compliance with the Law:

Filing taxes is a legal requirement in most countries. The government uses tax revenue to fund public goods and services, such as infrastructure, education, and healthcare. By filing your taxes, you're contributing to the well-being of your community.

2. Avoid Penalties and Fines:

Missing the tax filing deadline or failing to file taxes altogether can result in significant penalties and fines. These can add up quickly, so it's essential to file on time to avoid unnecessary costs.

3. Claim Refunds and Credits:

If you're eligible for tax refunds or credits, you'll need to file your taxes to claim them. This can put more money in your pocket, which can be used to pay off debt, save for the future, or cover unexpected expenses.

4. Protect Your Social Benefits:

In some countries, filing taxes is necessary to maintain eligibility for social benefits, such as Social Security or Medicare. If you fail to file, you may lose access to these essential benefits.

5. Build Credit and Financial Stability:

Filing taxes demonstrates financial responsibility and can help you build credit. This can make it easier to secure loans, credit cards, or mortgages in the future.What Happens If You Don't File Taxes?

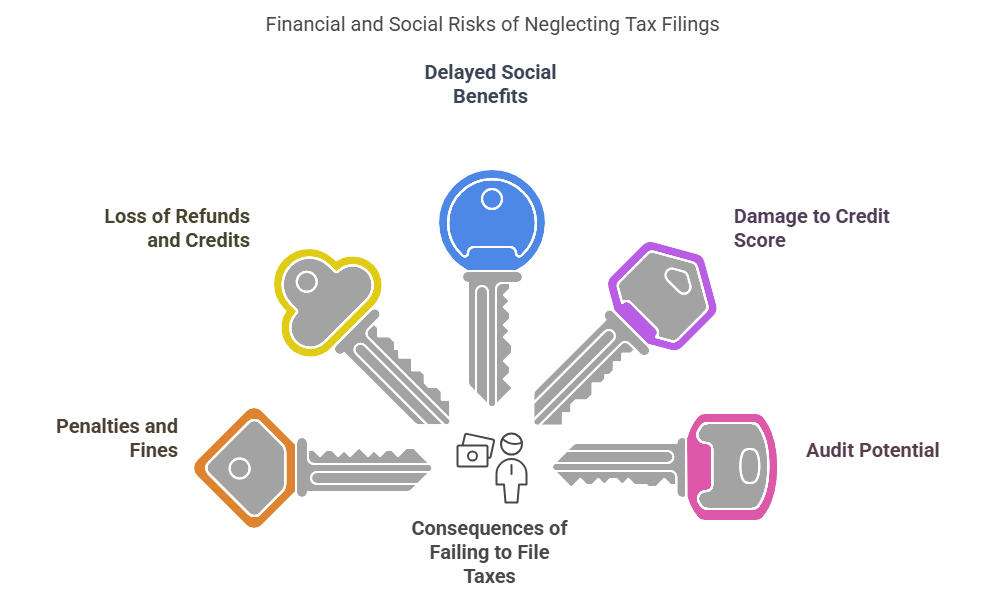

1. Penalties and Fines:

As mentioned earlier, missing the tax filing deadline or failing to file taxes can result in penalties and fines.

2. Loss of Refunds and Credits:

If you don't file your taxes, you may forfeit your right to claim refunds and credits.

3. Delayed or Denied Social Benefits:

Failing to file taxes can delay or deny your access to social benefits, such as Social Security or Medicare.

4. Damage to Credit Score:

Not filing taxes can negatively impact your credit score, making it harder to secure credit or loans in the future.

8 Comments

Sarah L. Reply

"I never realized how much my taxes contribute to local services until I started filing regularly. It feels good to know I'm making a difference in my community!"

James T. Reply

"The process of filing my taxes used to stress me out, but now I see it as an opportunity to support essential programs. Thank you for making it so easy to understand!"

Emily R. Reply

"I completely agree with you, James! I love how this service emphasizes community impact. It’s not just about numbers; it’s about real benefits for everyone in our neighborhood. When we file our taxes, we’re not merely fulfilling an obligation; we’re actively contributing to the services and programs that make our community thrive. Whether it’s funding for local schools, parks, or emergency services, our contributions create a ripple effect that enhances the quality of life for all of us. It's so encouraging to see a service that highlights this aspect, as it helps us feel more connected and invested in the well-being of our community. Understanding where our money goes truly transforms the way we view our responsibilities as citizens!"

Karen S. Reply

"I hear you, I used to dread tax season, but now I see it differently. It’s amazing how much perspective can change our feelings about these things!"

David W. Reply

"I used to view taxes as a burden, but now I understand their importance. This service has changed my perspective entirely!"

Tom S. Reply

"Thanks to this platform, I now see tax filing as a way to contribute positively to our society. Keep up the fantastic work!"